The foreign exchange market has always been known for its volatility and unpredictability. In recent days, significant changes have been taking place, which can affect the global economy and the financial well-being of individuals.

The US dollar continues to rise due to various factors such as declining oil prices, heightened geopolitical risks, concerns about inflation in the US, and a decrease in demand for risky assets. Additionally, decisions like the US Federal Reserve's interest rate hikes have also contributed to the dollar's growth.

The so-called "trade wars" between the US and China have also had an impact on the foreign exchange market. Over the long term, escalating tariffs and trade restrictions may lead to a further depreciation of the dollar and an increase in the value of the yuan.

However, one of the main factors is the persistent decline in oil prices, which leads to reduced revenues from oil and gas exports, which in turn can cause a decline in the US dollar. This situation could contribute to rising inflation and hinder economic growth.

Moreover, unemployment in America keeps rising, especially among young people and women, leading to reduction in consumer demand and decline in investment.

Recent population migration in the United States has also been high, which may incur additional costs for social security and healthcare.

In general, the latest economic news indicates that America continues to struggle with a number of challenges that can affect its economy. Although the US government remains committed to addressing these issues and finding new ways to maintain stability and foster economic growth.

In China, there is some uncertainty related to its economic state. In recent months, the country has faced challenges, such as slowing economic growth and high unemployment. Consequently, there has been a decrease in demand for Chinese goods and currency, causing the yuan to weaken against the dollar and other currencies. Nevertheless, China continues to be one of the world's largest economies, and any news related to its currency will most likely impact the global economy. Like any other, this news can always be tracked in the economic data calendar.

Over the past year, the exchange rate of the Chinese yuan against the US dollar has experienced fluctuations, but recently there has been a tendency of yuan weakening. This can be attributed to various factors, including trade wars, rising inflation, and diminished investor confidence in the Chinese economy. However, despite the strengthening of the yuan, its exchange rate still remains lower than in 2019, although it is approaching that level.

China's capital control policy remains in place, potentially limiting foreign investment inflows and impeding economic growth. It is also worth noting that China continues to implement banking sector reforms aimed at enhancing financial system transparency and stability. These reforms can positively influence economic stability and the investment climate in China.

The euro is also strengthening against the US dollar due to the growing market uncertainty and investor concerns about a possible recession in the USA.

Even though the latest report from Eurostat indicates that inflation in the eurozone in April was 7% (which is 0.2% higher than in March), on a larger scale, it has been decreasing since October 2022. Although this change is not critical, it could prompt the European Central Bank to adopt tighter monetary policies, potentially impacting economic activity in the region.

The eurozone has experienced a decrease in the unemployment rate, indicating an ongoing recovery of the European economy following the 2008 crisis and an overall improvement in the economic situation.

It seems that Europe remains committed to rebuilding its economy and addressing issues within the banking sector. However, to prevent future crises, it is crucial to continue implementing measures that strengthen financial stability and support economic growth.

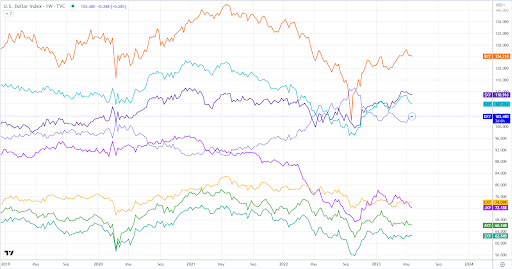

Comparing the index rates of leading countries on a unified chart can provide valuable insights for making decisions regarding currency investments.

Interesting Related Article: "Lockdown and Its Impact on the Global Economy"

No comments:

Post a Comment